|

- UID

- 12226

- 帖子

- 6753

- 精华

- 10

- 性别

- 男

- 来自

- 上海

- 注册时间

- 2008-4-12

访问个人博客

|

楼主

发表于 2014-5-10 17:27

发表于 2014-5-10 17:27

| 只看该作者

[转帖] 2014.05.02 中国信贷——无功,不受禄 By 邹斌

http://www.ecocn.org/thread-197934-1-1.html

Free exchange

自由交易

Taking credit for nothing

无功,不受禄

China’s credit boom has got people worried. Should they be?

中国信贷蓬勃发展,人们却开始担心?杞人忧天?

Jun 15th 2013 | From the print edition

IN HIS work on China’s economy, Zhang Zhiwei observes what he calls the “5:30 rule”. That is not the time he clocks off each day: he is a hard-working economist for Nomura, a Japanese bank. But the rule does refer to a time of reckoning of sorts. Mr Zhang points out that several economies have suffered financial crises after their stock of credit grew by about 30% of GDP in a span of five years or less. Japan fell foul of this rule in the latter half of the 1980s; America broke the limit in the years before 2007.

张智威在他关于中国经济的研究中提出了所谓的“5:30规则”。那不是他每天下班的点:他是一个在野村的日本银行努力工作的经济学家。但这个规则确实参考了各种精细时点。张指出,一些经济体先是饱受金融危机的折磨,然后在五年或者更短的时间内,他们的信贷规模增幅占到国内生产总值的约30%。日本在20世纪80年代后半期碰触到了这个规则,美国则是在07年之前的几年就打破了这个界限。

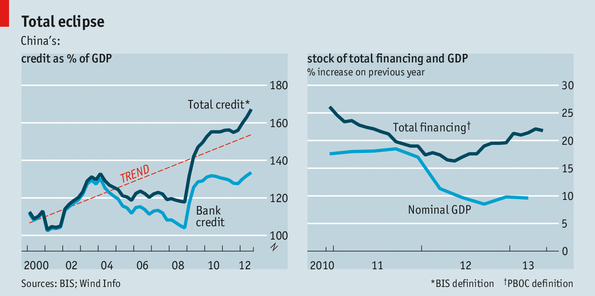

Now Mr Zhang is worried about China. At the end of 2008 total credit to firms and households (and to non-profit organisations) amounted to less than 118% of GDP, according to a new measure calculated by the Bank for International Settlements (BIS). By September 2012 the total stood at over 167%.

现在张担心的是中国会重蹈覆辙。国际结算银行根据其新算法统计得出:到08年末,中国的公司、家庭以及非营利组织的信贷总量将近占到国内生产总值的118%。到2012年九月份,这个数字会超过167%。

It is natural for credit to deepen over time in a developing country. But when credit departs too far from its underlying trend, trouble often ensues. Mathias Drehmann of the BIS calculates that when the deviation exceeds 10% of GDP, it serves as a reliable early warning of a crisis within the next three years. According to our calculations, China’s credit ratio now exceeds its trend by 14 percentage points (see left-hand chart).

发展中国家的信贷规模扩张是在再正常不过的事情,但是如果其偏离基本趋势太远,麻烦就会随之而来。国际结算银行的马赛厄斯•德鲁曼估计当差值超过国内生产总值的10%,那就是接下来3年内危机出现的可靠信号。根据我们的估算,中国的信贷比率偏差已经是14个百分点。

Mr Zhang is hardly the only one perturbed by this gap. It was a big reason why Fitch, a ratings agency, downgraded China in April. China’s policymakers have also taken note. In March the bank regulator urged banks to tidy up their off-balance-sheet investments. Last month China’s foreign-exchange regulator cracked down on illicit capital inflows. And earlier this month China’s central bank stood by as interbank lending rates spiked in advance of the Dragon Boat holiday (reportedly prompting one mid-sized bank to default on another). The authorities seem keen to set a slower, steadier paddle-speed, hoping for less splash and froth. In May the central bank’s broad measure of “total social financing” (TSF) at last slowed a little (see right-hand chart).

但张并不是唯一一个担心此问题的人。出于这个原因,评级机构惠誉4月份下调了中国的评级。中国的决策者们也注意到了这一变动。3月,监管机构下令银行清理表外投资业务。中国央行上个月用汇率手段限制了非法资本的流入。本月初,银行间借贷利率于端午节前骤升,报道称这导致一家中型银行对另一家违约,而央行则没有介入。官方似乎打算用一个更缓慢、更稳妥的速度以避免节外生枝。5月份,央行的 “社会融资总量”变化终于放慢了一点。(见右图)

The other side of China’s surging credit ratio is the surprisingly slow growth of nominal GDP. In the first quarter record amounts were added to total social financing, but growth was weak and inflation subdued. This wrongfooted both optimists (who thought lashings of credit would fuel a strong recovery) and pessimists (who expected it to fuel rapid inflation).

中国激增的信贷比率的另一面则是名义国民生产总值的缓步增长,这不由得让人惊讶。一季度,社会融资总量创纪录的增加,但经济增长疲软通胀减缓。不管是觉得抑制信贷会刺激经济复苏的乐观人士,还是认为其会加速通胀的悲观人士,都对此感到措手不及。

Ting Lu of Bank of America thinks this decoupling of credit, growth and prices is partly a statistical illusion. The official measure of financing, he argues, is marred by double counting. If a big firm borrows cheaply on the bond market, then lends less cheaply to another company, the same money will appear twice in the central bank’s measure of TSF (an eclectic mix of loans, bonds, bills and even some equity financing).

美国银行的路廷认为信贷、增长、和价格的消弱某种程度上算是数据错觉。在他看来,官方的融资手段被重复计算所破坏。如果一个大公司在债券市场以低利率借入,然后提高利率借给另一家公司,同一笔资金在央行的社会融资总量上会出现两次(贷款、债券、账单以及一些股权融资的电子合计)

A deeper explanation, argues Richard Werner of Southampton University, lies in flawed theory, not bad measurement. He revisited the link between credit, growth and prices after moving to Tokyo in 1990, just as its bubble was bursting. The years of overborrowing had many ill consequences. High consumer-price inflation was not among them. Based partly on this experience, he advocates a narrower view of credit’s origins and a more discriminating view of its purposes. Only banks can lend money into existence, he emphasises: their loans create deposits that can then be used to pay for things. Other financial institutions and instruments just transfer existing purchasing power between parties. His definition of credit creation would exclude the non-bank loans that have contributed so much to growth in TSF.

南安普顿大学的理查德•沃纳认为进一步的解释就是问题出在理论上,而非统计方法上。他于1990年搬到东京,当时正值房地产泡沫破裂,便再次审视了信贷,增长和价格之间的联系。数年的信贷泛滥带来许多后遗症,但高消费者价格并不属此列。基于此次经历,他提倡从一个更微观的角度来看待信贷的起源并且更好的鉴别它的目的。只有银行的贷款才能发挥最实际的影响。他强调:银行贷款创造了存款,这些存款可以用来进行支付。其他的金融机构或者工具只是在转移购买力。他对信贷产生的定义并不包括非银行贷款,虽然它对于社会融资总量的发展贡献良多。

Debt fret 债务烦扰

Mr Werner’s second observation is that credit also serves different purposes. Some is spent on consumer goods; some on creating new factories, buildings and other physical assets; and some on assets that already exist. The first two kinds of spending contribute directly to GDP, which measures outlays on freshly produced output. But the third kind does not. Since these assets already exist, their purchase does not add directly to production or inflationary pressure. The economy does not grow or strain at its limits when an existing tower block changes hands.

沃纳还认为信贷也有着不同的作用。一些用于购买消费品;一些用来建立新工厂,建筑以及其他的实体资产;另一些用于已经存在的资产。前两项支出直接提高了GDP,这衡量的是最新的输出。但第三种并不是这样。因为这些资产已经存在,有关他们的购买并不会直接增加生产或者通胀压力。当现有的资产转手时,经济的增长或者萎缩就会超过以往的界限。

In bubble-era Japan a lot of credit was of this third kind. It was ploughed into existing land and property, bidding up their prices to unsustainable heights. In China this kind of lending is not easy to distinguish in the data. But China does provide two different measures of investment. The first (gross fixed capital formation) measures investment in new physical assets, which contributes to GDP. The second (fixed-asset investment) adds in spending on already existing assets, including land. In 2008 both measures of investment were about equal. But spending on newly produced assets now amounts to only about 70% of fixed-asset investment, says M.K. Tang of Goldman Sachs. This suggests that existing assets are changing hands at a quickening pace and a rising price.

在日本泡沫经济时期,许多信贷就属于第三类。他们都被投入土地和地产的开发,价格跟着上涨,以至于到了难以承受的地步。但是在中国的此类数据中就很难分辨出此类借贷,然而中国却两种不同的投资统计方式。第一(总固定资本形式)衡量的是关于新实体资产的投资,这类投资直接贡献于GDP。第二(固定资产投资)则是针对现有资产的投资,包括土地。08年,两者差不多是相等的。高盛集团的M.K. Tang说,现在新建资产的投资只占固定资产投资的大概70%。这表明现有资产正转手的速度和价格都在不断升高。

How big a worry is that? Japan’s bubble left a lasting legacy. Savers discovered they were not as wealthy as their overpriced assets suggested. Debtors found they were not as wealthy as their outstanding liabilities required them to be. Banks retreated; animal spirits flagged. But credit booms do not always end so badly, as China’s own history shows. From 2001 to early 2004 total credit rose swiftly, violating the 5:30 rule. Towards the end of this period the central government had to inject $45 billion into two of China’s biggest banks to help them weather their past lending mistakes. But no crisis ensued. On the contrary, growth averaged more than 12% over the next three years.

但这能让人多操心呢?日本的泡沫留下了一连串的伤心回忆。储户们发现自身并不如资产的过高价格表现的那样富有。贷方则意识到他们的财力并没有赶上债务规模所要求的水平。银行业退却了,动物精神也萎缩了。但信贷膨胀并不总是以悲剧收尾,中国的历史就是例证。从2001年到2004年早起,信贷总量迅速增加,打破了五点半规则。04年初,中央政府向中国的两大银行注资450亿美元以帮助他们度过过去错误的贷款而引起的困难。但后来就没出现过别的危机。恰恰相反,接下来的三年里,经济平均增长率都在12%之上。

One difference between Japan and China’s earlier boom is that China’s state stood behind the banks and many of their borrowers, whereas Japan allowed bad debts to weigh on its banks and firms. China’s less developed economy also had more room to grow. Misguided loans and investments in the past did not inhibit fresh loans and investment in the future. China has changed radically in the past ten years. The hope is that even now it resembles Japan in the 1990s less than itself a decade ago.

日本和中国早期的繁荣区别之一在于当国内的银行以及公司遭遇债务危机时,中国举国鼎力支持,而日本却坐视不管。而且中国经济不如日本发达,因此上升空间更大。过去错误的贷款和投资并没有抑制新的贷款和投资势头。中国十年以来发生了翻天覆地的变化。希望在于虽然现在中国更像90年代的日本,但也远非10年前可比了。 |

豆瓣http://www.douban.com/people/knowcraft

博客http://www.yantan.cc/blog/?12226

微博http://weibo.com/1862276280 |

|